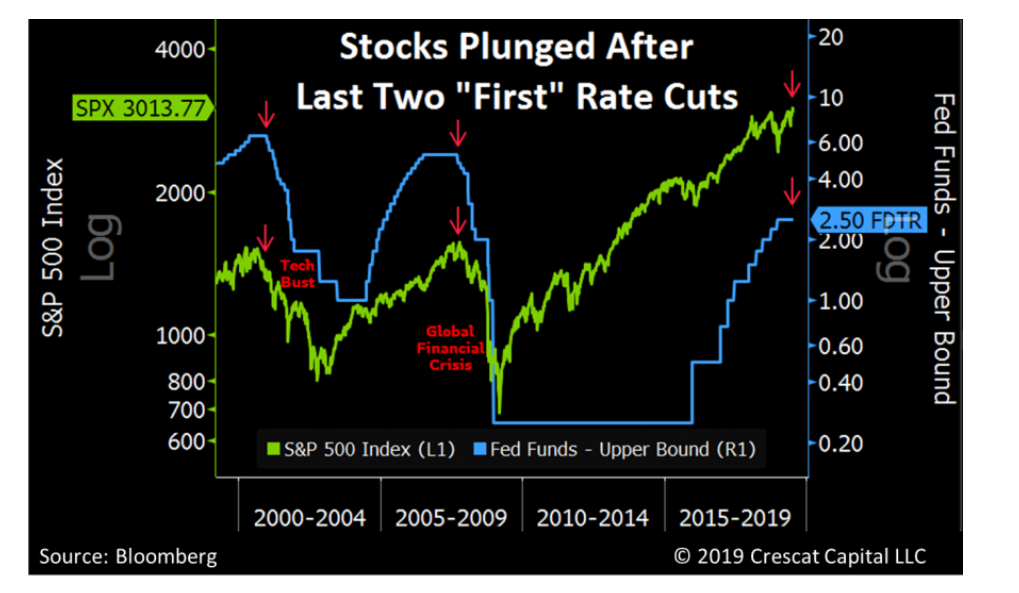

At the end of July the FED board is going to discuss a possible rate cut. The market is pricing an high probability of a rate cut which could boost stock prices; in this case is worth to take a look at a chart posted by Crescat Capital:

As we can see rate cuts seems to be no very bullish at market tops. Indeed, both in 2000 and 2008 they were the trigger for market meltdown. Thus, I’m not to bullish in this situation given the results of the last two cuts.

It’s interesting to see as well how the rate cuts led to a roughly 50% downturn in equities:

So, we could say that even in this case the SPY might drop by 50%, if this will be true the 1500 level it’s likely to be a support level where the index is gonna rembound.

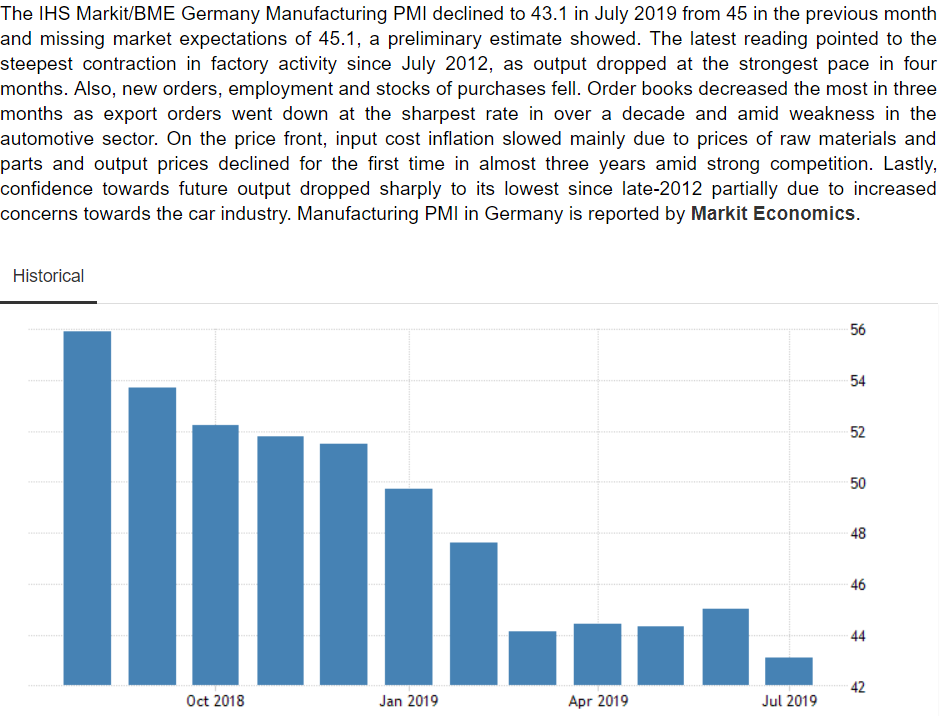

In the meanwhile, the Eurozone is already collapsing as the flash German PMI shown:

This will lead to a new era of QE in the eurozone and probably a 10 bps rate cut by the ECB maybe in September, or even before. Given the fact that the EU economy is very frigile, the only thing the ECB can do is easing even more, hence a very good trade could be go long sovreign bonds of most weak countries like Greece, Spain and Italy.

Lastly, I spotted a fractal on the Euro, let’s see how it plays out.

I do not take responabilities for your trades, these are just my opinions based on my research.